This is a common question and the answer depends very much on the service you want. You can look to instruct a conveyancer in another part of the country where the costs may be lower, but that conveyancer will have no knowledge of the local area and may not be able to advise you so fully as a result.

Even if you choose to instruct a local firm, prices will vary, and as with most things in life, if you choose solely on price then you may suffer on quality. This is because the cost of supplying the service varies based on:

- How qualified and/or experienced your conveyancer is (as in most jobs, experience and knowledge evidenced by qualifications increases salary expectations); and

- How much time that person has to spend on your matter.

Why do conveyancing costs vary?

The level of costs and more importantly, the amount of time your conveyancer can spend on your matter, are most significantly affected by the business model, which can be defined at extremes as:

- “Stack ‘em high and sell ‘em cheap”: Each conveyancer is expected to deal with a large number of transactions at a low fixed cost in order to pay their salary and other associated costs, leaving them little time to spend on each matter; or

- “The good ole fashioned way”: The conveyancer takes on the transactions they can handle and charges by the time spent at their hourly rate, which is set depending on their experience and/or qualifications giving little certainty on cost.

How much does conveyancing cost?

The actual costs of conveyancing involve far more than the cost of your conveyancer’s legal advice, which is generally a relatively small proportion of the sum you will need to pay. On the basis that you are selling and buying a property, the largest costs are likely to be:

- Estate Agent’s Sale Commission: 1-3% of the property price plus VAT (well done if you have achieved a lower price!).

- Stamp Duty Land Tax (SDLT): variable rates depending on the price of the property and decisions made by Government.

In addition to this, you pay for:

- Standard Property Searches on your purchase (required if you are obtaining a mortgage and advised even if you are not): £400 to £600 depending on the cost of a Local Authority Search, which varies by area.

- Land Registry Fees including priority searches on your purchase, bankruptcy searches, the retrieval of official copies of the register on your sale and registration of your ownership of the purchase property: The total varies in relation to the purchase price but may be up to £300.

- Identification checks required to comply with regulations for the prevention of Money Laundering.

- Bank Transfer Fees: fees for transferring large amounts of funds between you and your seller and from your conveyancer to you if there is a surplus. Generally £48 (inclusive of VAT) per transfer.

- Mortgage Valuation fees: Somewhere between £150 and £1,500 depending on your lender and the value of the property. You should also consider any fees that may be payable to your mortgage advisor. Other fees may also apply.

- Surveyors fees: It is generally advisable to have your own survey done to establish any issues that may affect the property you are purchasing as you cannot rely on the Mortgage Valuation which will not look for any structural defects, damp etc in any case. These costs can vary significantly based on the extent of the survey and the size of the property.

- Leasehold Costs: generally in the hundreds and including the cost of notices, information regarding the state and management of the property and any apportioned service charges or ground rent due on completion.

Of course, the final item is the cost of your conveyancer’s legal advice. As set out above, this can vary significantly. Some firms also pay referral fees to your Estate Agent for sending you to them. Such referral fees are generally in the hundreds, with a local firm confirming that their average fee is £267.

What is the cost of conveyancing with Heringtons?

At Heringtons we try to steer a middle course between the extremes of business model.

We offer a fixed fee service, the details of which are available to you here on our website, giving you as much certainty as possible in relation to the costs you will pay. We also set out further details regarding the costs mentioned above. There will be no referral fee paid to your Estate Agent as we attract our client’s through recommendations and word of mouth.

The level of fees reflects the time put in by our property team ensuring that they have the time properly advise you in relation to what is usually the highest priced item you will ever buy. This does mean that at busy times we may be forced to decline your instructions as the team does not have sufficient capacity to give your transaction the time you deserve.

Why should I trust you?

We are not the only people saying these things, check out this article in the Property Industry Eye setting out the difficulties faced by conveyancers working with the “Stack ‘em high, sell ‘em cheap” model”.

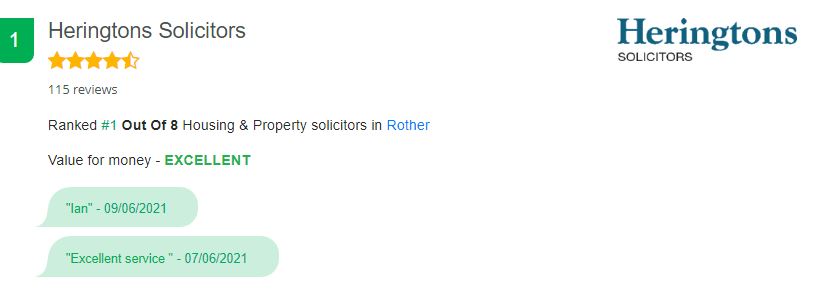

You can also see the great reviews our Property Team have received on Review Solicitors website here

Comments takem from one of our client questionnaires from Lynn Haffenden-Edwards: “I can’t fault your service. We used an online solicitor for conveyancing for the sale of mum’s house and if I had filled a questionnaire in for them the answers would all have been “adequate” or “poor”. I would never use an online solicitor!”

And find out more about our property services here

_____________________________________

Article written by Rosemarie Close, Solicitor